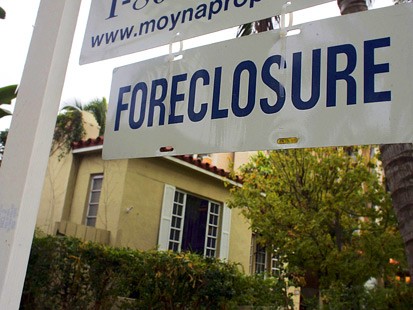

Proactive Foresclosure Mediation Program?

(originally posted @ www.EnjoyMediation.com)

I believe this might be a first- a State Bill in Vermont is suggesting mediation be required before a home goes into foreclosure.

From Businessweek.com: A bill passed by the Vermont House on Thursday seeks to address concerns like hers. It calls for mediation between lenders and homeowners before a home foreclosure goes forward.

From my understanding (and of course I could be wrong!) this is the first proposed Bill that is actually proactive in trying to prevent the filing for foreclosure. In the other 25 states, the foreclosure mediation programs provide mediation services after the house has gone into foreclosure.

It brings up many of issues, including why should a lender be prevented from filing until after a mediation session? Also, as with mediation in general, there is no way to compel the lender to negotiate in good faith.

The article adds:

Backers of the legislation in Vermont say the state did not see the widespread predatory lending seen in many parts of the country during the last decade, but the recession and mounting unemployment have meant a sharp rise in foreclosures anyway.

House Speaker Shap Smith, D-Morristown, said foreclosures in Vermont were up 50 percent from 2007 to 2009. Christopher D'Elia, president of the Vermont Bankers Association, said the state saw 1,924 foreclosure filings in 2009.

-

Comment by John C. Turley on April 9, 2010 at 5:13pm

-

Jeff:

I believe that you are correct concerning the Vermont bill as a first in suggesting mediation be required before a home goes into foreclosure. As a REALTOR in Michigan, I developed an ODR mediation process and bank proposal for Professor Rainey's 737 ODR class. I suggested mediation at the critical step when the borrower is in default on their mortgage, and the bank starts the foreclosure process. Within this window, I advise a time-out in the foreclosure proceedings with an ODR session between the bank, the borrower and a mediation specialist in real estate foreclosure transactions. With some effort and cooperation from the principal mortgage lenders, I forsee significant financial relief for the distressed borrowers, a higher negotiated payoff to the banks in lieu of a lesser bank payoff at the end of the redemption period, and a new niche for ODR practicioners. I am currently pitching my idea to the banks and the NAR and will report further as I gain traction.

JCT

Comment

About

@ADRHub Tweets

© 2026 Created by ADRhub.com - Creighton NCR.

Powered by

![]()

You need to be a member of ADRhub to add comments!

Join ADRhub